In the early 2000s, the term "cord-cutting" entered the lexicon, referring to the at-the-time novel phenomenon of people ditching their cable TV subscriptions for direct-to-consumer (DTC) streaming services. The wave that started back then has never crested: dependably and in increasing numbers, consumers have been shifting to the connected TV (CTV) paradigm.

The advertising world took a little while to catch up to this phenomenon, but today it is making up for lost time, and then some: CTV ad spend is projected to reach $33.35 billion in 2025, a milestone helped along by the proliferation of more affordable, ad-supported tiers on top streaming platforms such as Netflix, Max, Amazon Prime Video, Disney+, and many others.

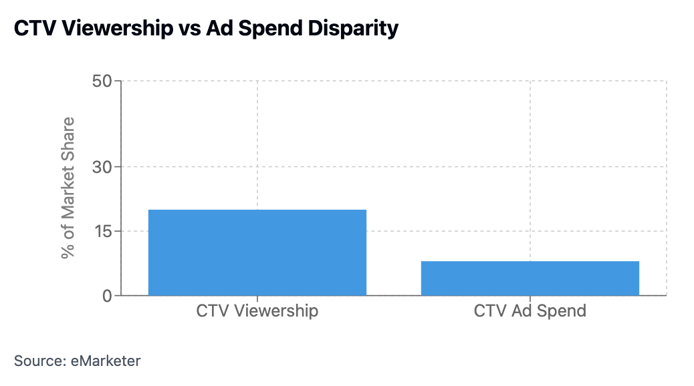

Yet, despite these eye-popping numbers, there's a disconnect at play. While CTV viewership has surged to the point that it now makes up 20% of adult media consumption in the US, it currently only receives around 8% of total ad spend, according to eMarketer. This is because, despite unusually high engagement levels, the CTV advertising space is beset by legacy technology challenges.

These challenges are far from intractable—but they are pervasive, and understanding them is a prerequisite to closing CTV's massive monetization gap between time spent and budgets allocated. With annual US media spend at roughly $390 billion, there is roughly $47 billion in earned but unrealized revenue up for grabs if media owners have the will and technology to win it.

The challenges holding CTV advertising back

While CTV's potential is clear, several fundamental technical and operational challenges are preventing media owners from fully capitalizing on this opportunity.

Low ad fill rates

One could argue that CTV owners are a victim of their own success: they are struggling to attract advertisers precisely because they've been so successful at attracting viewers. Put another way: the explosion in CTV inventory, and the sluggish evolution of a parallel ad tech ecosystem, has led to stubbornly low fill rates across the industry.

A recent report from One Touch Intelligence drives the point home: right now, ad fill rates for the FAST (Free Ad-Supported Streaming TV) market are topping out at only 38%.

Cross-channel user experience

The consequences of low fill rates extend far beyond simply missing out on advertiser revenue—they also annoy existing customers and prejudice them against advertisers. Beloved shows will suddenly be interrupted by dead air, or by the same ad the viewer has already seen a dozen times already (because low fill rates invariably lead to the removal of frequency caps). Worse yet, low fill rates mean these ads often aren't even personalized or relevant, which further alienates viewers.

Legacy ad servers

Behind the scenes, there are also the problems familiar to anyone experienced in conventional web advertising: a broken programmatic pipeline, outdated auction solutions, pervasive bid duplication. Also—compounding these problems at every turn—a lack of transparency and communication within the overall technological ecosystem. Arguably, the unique needs and formats of CTV as compared to traditional web advertising make these problems even worse—demanding new methods to maximize CTV's potential.

Lack of transparency

If CTV owners are struggling to demonstrate this massive potential to advertisers, it’s in large part because of inadequate measurement and attribution methods: to many advertisers, CTV can seem like a black box. It’s not surprising that some advertisers are hesitant to allocate more resources to CTV: they need to know that their investments are actually paying off.

But providing that evidence demands a high level of technical expertise. CTV owners need the willingness and ability to navigate proliferating data sources, massively complicated tech-stacks and ever-shifting regulations. CTV owners—many of them emerging from the traditional linear television space—lack this expertise, and in consequence are failing to capitalize on exploding viewership.

AI and machine learning unlock CTV's revenue potential

In CTV advertising as in web advertising, one thing is clear: an embrace of AI and machine learning is the only way forward. Media owners must adopt intelligent ad servers to deliver on the promise of programmatic CTV advertising and close the advertising gap—earning their fair share of ad dollars for the time audiences spend streaming their premium video.

AI and automation solve broken auctions

We know that the auction system as currently constituted is broken. Machine-learning algorithms optimize this process. They take what was cumbersome, outdated, and pointlessly rule-based, and turn it into something suited for the moment we live in. By redefining unified auctions, this ML/AI-driven technology optimizes yield from every demand pipe in real time—automating ad sales, increasing fill rates, and (most importantly) maximizing revenue.

Real-time bidding unlocks maximum yield

CTV owners deserve the highest possible value for their content; after all, audiences are rarely more engaged than when they're in the middle of a beloved TV show. Automated real-time bidding—by facilitating genuine competition between advertisers—unlocks this potential and ensures CTV owners realize the true potential of their inventory.

Advanced tech eliminates the worst ad fraud

CTV owners know that what they're offering is worthwhile, but until advertisers can fully trust the process, they will continue to struggle with low fill rates. Here, too, automated technology has significant applications. Take the problem of ad fraud, which the Video Advertising Bureau found costs CTV owners $6 to $8 million a month. Tactics like device spoofing have been rampant in CTV and other forms of advertising, drastically reducing advertiser confidence. Advanced technology can handily take care of this problem—giving advertisers less to worry about.

Robust reporting that unlocks bigger budgets

The main sticking point for advertisers to date has been the lack of transparency in CTV advertising, and this is where emergent AI-enhanced technology can really shine. Through improved measurement and clear reporting, CTV owners can provide advertisers with the kinds of robust behavior and performance metrics that can guide decision-making and inspire true confidence. This includes supply- and demand-level reporting, granular insights on ad performance, and demand response profiles.

Now is the time to scale your programmatic CTV revenue

It is almost impossible to overstate the revenue potential presented by CTV advertising. Unlike traditional linear TV—when consumers would watch something simply because it was on—the expanding ranks of CTV viewers today make their own decisions about what to watch. Subsequently, they are maximally engaged—and maximally receptive to advertiser content. Combined with ads that are themselves personalized—more engaging, and more relevant to consumers' interests—CTV represents an unbelievably potent ad-delivery mechanism whose revenue potential is just beginning to take off. It is, in a sense, the best of both worlds: the immersion of linear TV combined with the dynamism of digital advertising.

Yes, the challenges are real, and they've prevented CTV owners from realizing their full potential so far. But with the right tools in place, the potential is truly limitless.

Want to learn more about EX․CO's ad server for CTV? Drop us a line below.